ii. 15% for married individuals filing jointly, surviving spouses and heads of household with taxable income over $1 million.

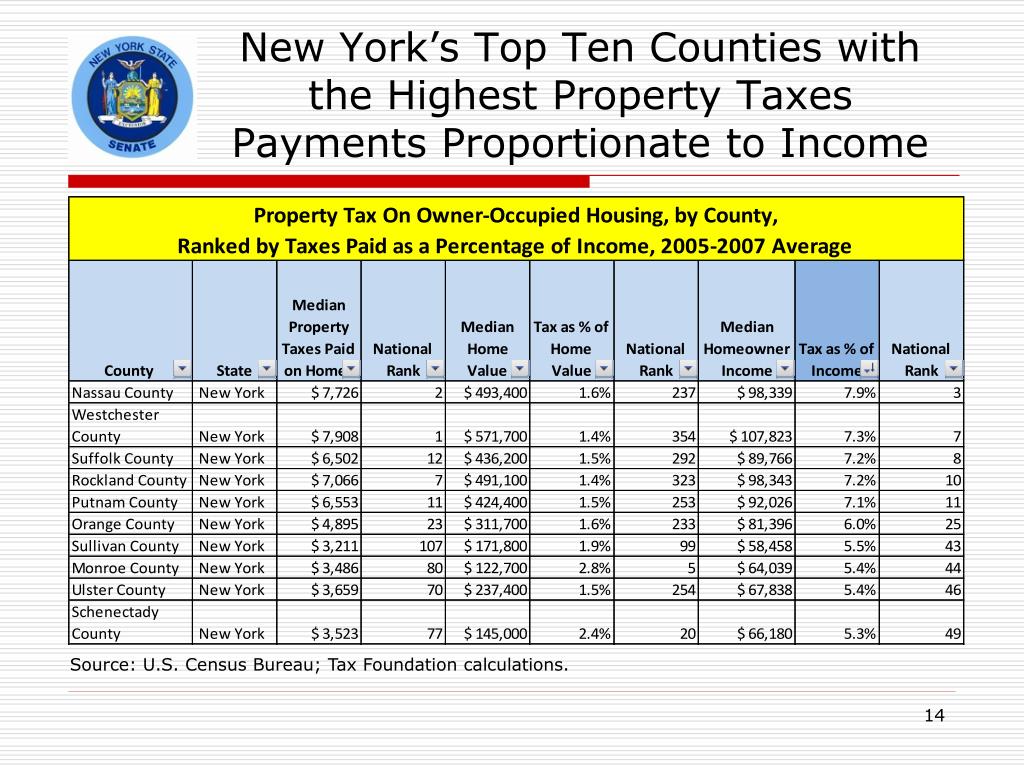

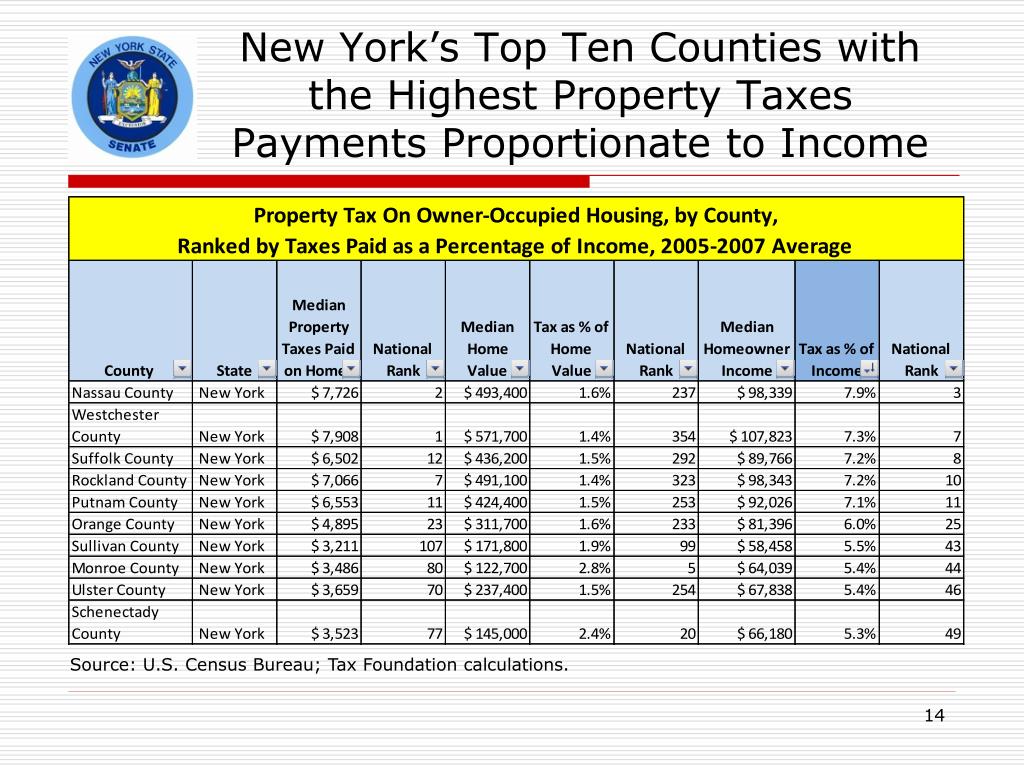

i. 7.5% for married individuals filing jointly, surviving spouses and heads of household with taxable income over $500,000. Senate Bill 2162, introduced on January 19, proposed an additional tax on long-term capital gains, dividends or any other type of capital gain income of: The New York proposal seeks to increase capital gains rates and adds to existing bills introduced earlier this month and in 2021, which are summarized briefly below. The pending proposals are similar to those promoted by Massachusetts Senator Elizabeth Warren during her 2020 presidential campaign and were funded by Fund Our Future, a tax policy advocacy group. An experienced estate planning attorney uses strategic tax planning as part of an estate plan, minimizing tax liability and preserving assets.On Thursday, January 19, New York and Connecticut lawmakers, along with legislators from California, Hawaii, Illinois, Maryland and Washington, introduced tax legislation targeting wealthy taxpayers. It’s not necessary to move purely to avoid estate or inheritance taxes. New York, New Jersey, Rhode Island, Oregon, Vermont and Washington have no inheritance taxes, while Pennsylvania has no estate tax but does have an inheritance tax. Any taxable gifts made three years prior to death are included. Minnesota has a low estate tax exemption of $3 million. Massachusetts has no inheritance tax and a $1 million estate tax exemption. Maryland’s has both an estate tax exemption of $5 million and a flat 10% inheritance tax. Maine has an estate tax exemption of $5.87 million, but no inheritance tax. However, depending upon your relationship to the person who died and the value of the property, the inheritance tax is 4% to 16%. No taxes are due on property inherited by a lineal ascendent or descendent, but for other family members, the taxes range from 8%-12%. In the meantime, there’s no estate tax, and if the estate is valued at less than $25,000, there’s no tax. Iowa is phasing out those taxes, but this doesn’t take effect until 2025. It’s known as one of the least taxpayer friendly states in the country for retirees. Illinois’s estate tax is $4 million, but there’s no inheritance tax. Hawaii’s estate tax exemption level is $5.49 million., one of the higher state estate tax exclusions, and is not adjusted for inflation. The District of Columbia has an estate tax, with an exemption level of $4 million. The Nutmeg state is the only state with a gift tax on assets gifted during one’s life.

i. 7.5% for married individuals filing jointly, surviving spouses and heads of household with taxable income over $500,000. Senate Bill 2162, introduced on January 19, proposed an additional tax on long-term capital gains, dividends or any other type of capital gain income of: The New York proposal seeks to increase capital gains rates and adds to existing bills introduced earlier this month and in 2021, which are summarized briefly below. The pending proposals are similar to those promoted by Massachusetts Senator Elizabeth Warren during her 2020 presidential campaign and were funded by Fund Our Future, a tax policy advocacy group. An experienced estate planning attorney uses strategic tax planning as part of an estate plan, minimizing tax liability and preserving assets.On Thursday, January 19, New York and Connecticut lawmakers, along with legislators from California, Hawaii, Illinois, Maryland and Washington, introduced tax legislation targeting wealthy taxpayers. It’s not necessary to move purely to avoid estate or inheritance taxes. New York, New Jersey, Rhode Island, Oregon, Vermont and Washington have no inheritance taxes, while Pennsylvania has no estate tax but does have an inheritance tax. Any taxable gifts made three years prior to death are included. Minnesota has a low estate tax exemption of $3 million. Massachusetts has no inheritance tax and a $1 million estate tax exemption. Maryland’s has both an estate tax exemption of $5 million and a flat 10% inheritance tax. Maine has an estate tax exemption of $5.87 million, but no inheritance tax. However, depending upon your relationship to the person who died and the value of the property, the inheritance tax is 4% to 16%. No taxes are due on property inherited by a lineal ascendent or descendent, but for other family members, the taxes range from 8%-12%. In the meantime, there’s no estate tax, and if the estate is valued at less than $25,000, there’s no tax. Iowa is phasing out those taxes, but this doesn’t take effect until 2025. It’s known as one of the least taxpayer friendly states in the country for retirees. Illinois’s estate tax is $4 million, but there’s no inheritance tax. Hawaii’s estate tax exemption level is $5.49 million., one of the higher state estate tax exclusions, and is not adjusted for inflation. The District of Columbia has an estate tax, with an exemption level of $4 million. The Nutmeg state is the only state with a gift tax on assets gifted during one’s life.

Here's how some state taxes look in 2022:Ĭonnecticut has an estate tax, with an exemption level at $7.1 million. However, a dozen states and the District of Columbia still have estate taxes, six states have an inheritance tax and one has both an estate and inheritance tax: Maryland. We do, because states have their own estate taxes, and a few still have such taxes.Ī number of states eliminated estate taxes in the last ten years or so, in an effort to keep retirees from leaving and heading to places like Florida, where there’s no estate tax. This isn’t to say “regular people” don’t need to worry about death taxes. Even better for the very wealthy, there’s no federal inheritance tax for heirs who reside in such lofty economic brackets, notes the recent article titled “States with Scary Death Taxes” from Kiplinger.īy definition, estate taxes are paid by the estate and based on the estate’s overall value, while inheritance taxes are paid by the individual who inherits property, assets, or anything else of value. In 2022, only estates valued at $12.06 million or more for an individual ($24.12 million or more for a married couple) need to pay federal estate taxes. For now, most people don’t have to be scared of federal estate taxes.

0 kommentar(er)

0 kommentar(er)